Share this

By Prof Alper Kara (Brunel University London) and Dr Atilla Gumus (Nottingham Trent University)

20 Sep 2023

Prof Alper Kara is Professor of Banking and Finance at Brunel University London, and Dr Atilla Gumus is Senior Lecturer in Financial Economics at Nottingham Trent University

UK households have one of the highest debt levels in the world. Steadily increasing in the last two decades, the average total debt per household (including mortgages) is £65,619 as of August 2023. This is £34,644 per adult, or around 103.5% of average earnings.

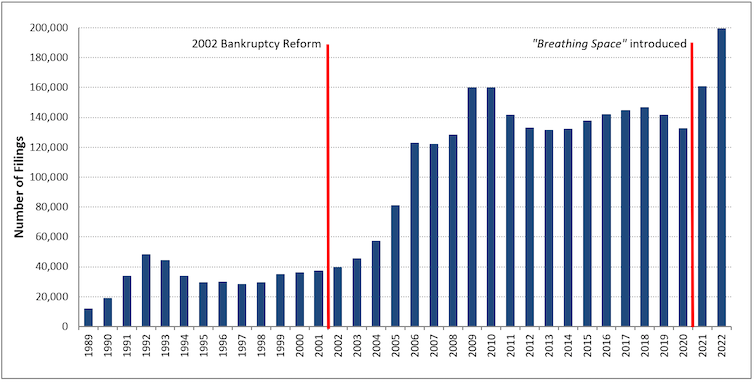

As indebtedness has steadily increased over the last two decades, household bankruptcies have quadrupled, reaching around 200,000 filings in 2022. One of the main reasons of this increase is arguably the 2002 UK bankruptcy reform, which made it easier for people to file for bankruptcy.

Consumer bankruptcies are rising in the UK

Bankruptcy in the UK

While the use of some types of debt relief agreements have fallen in the year to August 2023, according to the latest government figures, registrations for the government’s “breathing space” scheme – which gives debtors 60 days relief from pursuit by creditors – grew by 19% over this time.

The cost of living crisis is probably one of the main reasons for this spike in bankruptcy figures. Families across the country have been struggling to keep up with the rising price of essential goods and increased borrowing rates since mid-2021. At the end of last year, UK pay adjusted for inflation also fell at the fastest rate in 20 years.

Other factors can also trigger bankruptcy, however. Our recent study highlights two main reasons. First, we found that people tend to go bankrupt strategically – if they can financially benefit from it. This often happens when a person’s debt is far greater than the assets they have to liquidate (or sell) as part of the bankruptcy.

Second, adverse life events such as divorce, serious health problems or sudden unemployment can cause financial distress. This often takes the form of loss of income and further borrowing. This affects people’s ability to repay their debt, eventually leading to bankruptcy.

The options when struggling with debt

Filing for bankruptcy is a formal process for cancelling your debts (also known as discharging, or sequestration in Scotland) if you are having trouble making repayments. Consumer organisations such as Citizens Advice in the UK can provide information to help you decide if bankruptcy is the right choice for you.

If you do decide to declare bankruptcy, a court issues a bankruptcy order after an application by you or one of the people you owe money to (your creditors, for example a bank or a supplier if you are a business). Full discharge from debt usually happens 12 months after a bankruptcy order is granted.

But bankruptcy isn’t the only option if you’re struggling financially. A debt relief order (DRO) is a simpler, faster process for people with low income, fewer assets and debts of less than £30,000. When a DRO ends, typically after 12 months, most of your debts will be written off but some types aren’t covered. So, it’s important to check what types are included under this arrangement.

Alternatively, you could enter into an individual voluntary arrangement (IVA), which is a contract with your creditors. There is no maximum limit to the amount of debt that can be included in an IVA but at least 75% of your creditors have to agree to the plan. An administration order (AO) is a simpler version of this for people with debts of less than £5,000. In Scotland, a protected trust deed (PTD) provides the same kind of agreement.

Under IVAs, AOs and PTDs, you agree to repay your debt based on a new repayment plan negotiated by an independent professional called an insolvency practitioner. The plan is approved by the court and your creditors have to stick to it too. The renegotiated repayments are usually made in the form of a single monthly payment or a one-off lump sum.

And during your repayment plan you cannot take out new credit without a written permission from your insolvency practitioner. Bankruptcy proceedings are shown in your credit report for 6 years and new lenders will be able to see that.

A debt management plan is a fourth option for people struggling financially. It is an agreement with creditors to stick to a new repayment plan, negotiated by a licensed debt management company. Unlike the other options, debt management plans are not legally binding, so any or all of your creditors don’t have to agree on a plan and they can chase you for repayments individually. This is known as debt arrangement scheme (DAS) in Scotland.

Getting some breathing space

The UK government launched its breathing space scheme in May 2021. And it has clearly been useful for struggling individuals in the midst of the cost of living crisis – registrations increased by 28% in the year to July 2023.

It allows you to seek legal protection from pursuit by your creditors for 60 days. During this period, most interest and penalty charges are frozen, enforcement action is halted and your creditors cannot contact you about your debts. But you still need to make your repayments.

A version of the scheme is also offered to individuals who are getting mental health crisis treatment. The protection from creditors is for the length of treatment plus 30 days.

Breathing space is a temporary protection and could be a helpful first step to give you some time to plan your finances, but what about after that? Our research shows bankrupt individuals face difficulties borrowing again after bankruptcy.

If you completely discharge your debt, the impact on your borrowing ability is dramatic and swift but short lived – a year on average. But for debt restructuring, future borrowing limitations can last as long as three years.

That’s why it’s important to carefully consider your options if you can’t manage your debt commitments to make sure you find the best fit for your financial situation.

This article is republished from The Conversation under a Creative Commons license. Read the original.

Reported by:

Press Office,

Media Relations

+44 (0)1895 266867

press-office@brunel.ac.uk